It’s tax season in the U.S., and the IRS wants to know if you sold or bought any cryptocurrencies in 2019.

For the first time, the IRS will ask if “At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

Virtual currency is an important addition to the 1040 this year,” IRS Commissioner Charles Rettig said in a press release. “This emerging area is a priority for the IRS, and we want to help taxpayers understand their obligations involving virtual currency. We will also take steps to ensure fair enforcement of the tax laws for those who don’t follow the rules involving virtual currency.

While it might seem like a simple yes or no question, there are several ways in which you may have interacted with cryptocurrencies. And if you say no, it’s still possible that tax authorities may find out anyways. The IRS sent letters to more than 10,000 taxpayers in 2019 who it suspected had failed to report transactions as income.

How The IRS Handles Crypto

Virtually currencies are treated as property by the IRS, similar to stocks investment. Just like your stock portfolio, they expect you to report how much you received and pay income on those transactions.

Cryptos are not qualified as currencies, which means that you cannot claim foreign currency loss or gains. Buying and selling cryptocurrency is taxable, as is mining any currency.

Meanwhile, if you are paid virtual currency from an employer, it is treated as wages and must pay income tax, FICA tax, and unemployment taxes. If you’re a contractor, then you will have to pay self-employment tax.

What To Do If You Had Crypto Transactions In 2019

If you received any virtual currency and owe income taxes to the U.S, then make sure you answer yes to the IRS’s question about crypto. You must include the fair market value of that currency in U.S. dollars at the time cryptos were received. Check the dates of when you received crypto to make sure you are putting the right price in, as the crypto market can be volatile from day-to-day.

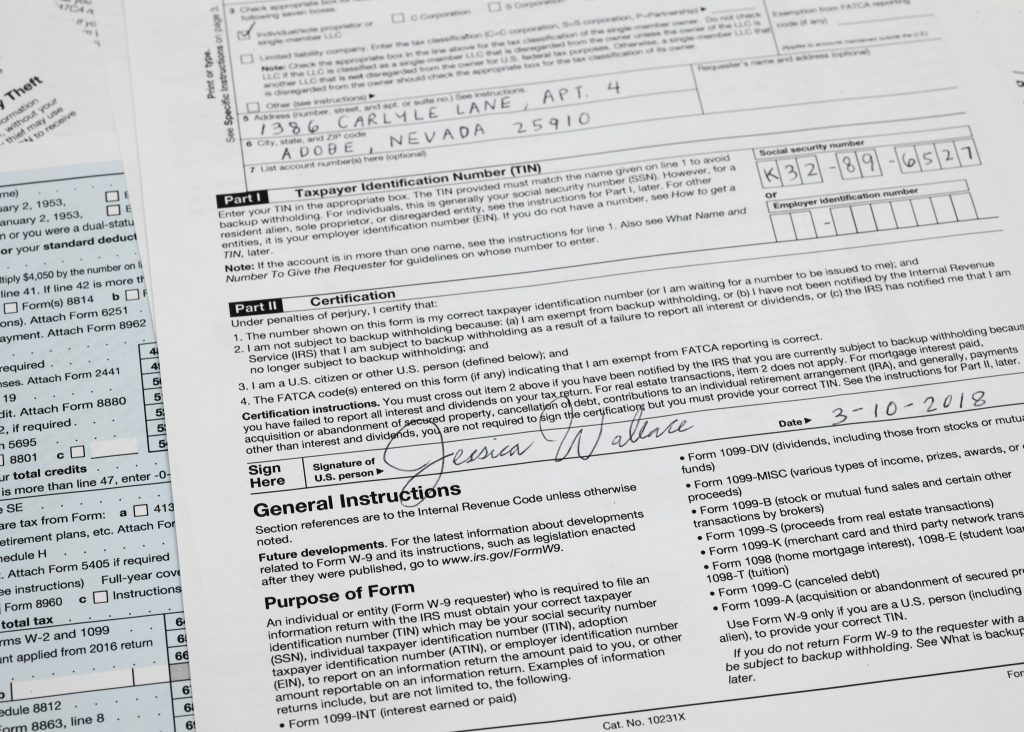

You want to create a paper trail, as even the smallest transaction could be taxed. While some crypto exchanges like Coinbase give you a Form 1099-K with your operations, not all crypto exchanges keep track, or they may only provide you with one if you had a certain amount of transactions. The best way is to keep track of your crypto transactions is to do it by yourself.

The price of not reporting your crypto operations could be costly and may get you audited by the IRS. You could get a fine of up to $250,00 and possibly face prison time in the most extreme cases.