Zidisha connects entrepreneurs in developing countries to funds in order for them to accelerate their businesses, further their educations, settle medical bills, and pursue any project which is clearly defined. Our entrepreneurs are of all ages and are in various parts of the world, including on the African continent (Burkina Faso, Ghana, Guinea, Kenya, Niger, Rwanda, Senegal, Zambia); in the Caribbean (Haiti); in Asia (Indonesia); and on the North-American continent (Mexico). Most entrepreneurs run one or more small businesses. Funds are provided by lenders who bid on individual borrower projects. This is an innovative P2P model because it takes crowd-funding and applies it to microfinance.

The typical volunteer at Zidisha is a graduate student in global economics and many of us have itchy feet to travel, so being virtual serves us well. We can work asynchronously, and we strive to manage our workload by recruiting a growing team of passionate smart folks who volunteer between 10 hours per week to full-time. At Zidisha, we are encouraged to come up with our own projects that augment the lending workflow. Many of the volunteers are interested in economic development and have been to the grounds of countries we serve, either for Zidisha or with other organizations. I learned a lot about new countries that I would never have been able to before because our global reach is high. The people I volunteer with are in every part of the world too, and I love that. To make sure the platform is usable from the borrower’s perspective, we welcome volunteers, men and women, who have lived in the countries we serve and are interested in the IT that allows our ambitious microfinance project to run smoothly.

We have a Slack channel called “open meetings” where our founder Julia Kurnia every month shares statistics about Zidisha. Something that caught my eye is a 20% higher on-time repayment rate over the last 6 months, which came from having volunteer mentors make a phone call to each applicant and requiring a positive recommendation from the mentor before approving the loan. Our volunteer mentors are entrepreneurs in the community who want the added responsibility of screening and coaching other entrepreneurs. I am working on a social media page that helps volunteer mentors interact with their community and add more entrepreneurs to Zidisha who are prepared to overcome business challenges. Some other milestones include surpassing 100K users on Zidisha (lenders and borrowers combined). The main challenges of this growth are making sure we are scaleable in disambiguating legitimate projects from fraudulent projects, communicating to entrepreneurs our changing expectations and policies, and growing our funding base! We have raised close to $10 million in 8 years, and by this fall we hope to add another $10 million in funding.

We encourage our readers to become lenders so that we can continue to fund our amazing entrepreneurs. Lenders can use Paypal on the Zidisha website; a credit card does not have to be used. As one of our staff members who is a lender herself, explains, “the money I initially uploaded has tripled in lending value, so far”. Our lenders are from the U.S. and Europe and they can even form lending groups. Lending groups are a cool feature because people interested in similar projects can band together, or reflect an organization with multiple Zidisha lending members. We do not allow lenders in the countries we serve because this could pose potential problems, such as collusion. The rate of loan repayment, or ROI in traditional finance, has been about 75.7% overall, but the different lending accounts are made to interact with the platform differently. We are a platform for philanthropy so all of our lenders want to help but some may want to be more secure with their contribution.

While you can read our FAQ to learn more about our accounts, we hope to give you a good picture of what sort of account to open depending on what sort of lender you are. With a non-donation lending account, no contributions toward funding loans are tax-deductible, and the lender can get reimbursed up to $1,000 in case of late payment or default, in addition to withdrawing repaid funds at any time. With a donation lending account, the lender donates all uploaded funds (hence the name of the type of account) and therefore cannot withdraw repaid funds from the account; however, all uploaded funds are tax-deductible in the United States, and will be reimbursed any time a repayment is late or default. The “Impact Investment” lending account is new and appeals to a more competitive lender. The entrepreneurs you select will be quicker to receive a loan because the 5% service fee charged on each loan gets recycled into these projects. “Impact investments” do not allow withdrawals so it is still meant to be philanthropic. Once you have invested your money in an “Impact Investment” account, you have truly helped our system grow bigger. The way Zidisha works is all about creating growth and implicitly helping entrepreneurs to incentivize each other.

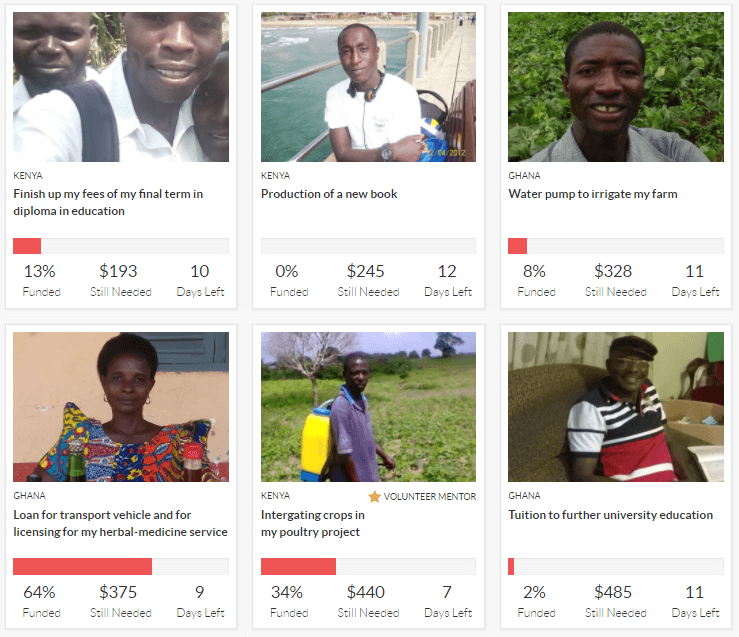

The experience between lenders and borrowers is very positive and friendly. Most lenders are business people themselves and they enjoy learning a bit about each other’s cultures. I certainly found it interesting to see the type of information entrepreneurs share in their loan profiles, particularly the societal struggles growing up. It’s honest and frank. We encourage entrepreneurs to share updates with pictures to present their narrative. We like when lenders are patient with our entrepreneurs and entrepreneurs are allowed to repay their loans flexibly. Lenders learn that it seems to be much easier to set up a business in some other countries in reference to legal regulations and costs such as liability insurances, but we also see how similar to us they are, too. Their cultures are going through the rough patches of industrialization. Our staff members have said they liked seeing the traditional beadwork and clothing and often wonder about importing them. I have worked with other organizations that help artists in developing countries buy the machines to continue doing these fine works, and while Zidisha helps many types of businesses, we have a soft spot for art. Entrepreneurs have been interested in growing their business ventures outside of their countries, but these sorts of global partnerships would require looking into how we maybe could help support the customs/duty fees that would need to be paid.

I think cryptocurrencies could be a powerful tool for Zidisha if we support more novel algorithms in how the money is being invested between the lender and borrower, for example Sikoba. If borrowers could fund each other or the volunteer mentors were financially backed, we may need to look into cryptocurrencies. Bringing in more government intervention so that all of the parties involved, including the mobile-payment providers, could be audited would require the use of blockchain. We do struggle to move our money in a timely fashion as our user base grows, so using cryptocurrencies could significantly reduce the amount of time to transfer money. Mobile money has already done this to an extent. The number of loans has increased substantially because people are looking to borrow in small amounts, a trend seen in mobile banking and microfinance. And big data has replaced loan officers, as metadata (for example, providing a Facebook photo) could be grounds for rejecting a profile.

To learn more about Zidisha, please check out our website or send us an email!