Earning passive income with cryptos is tempting and this temptation can be satisfied at a price. Margin lending is one way of earning an interest on the cryptocurrency. In order to do this investors,

Margin lending is one way of earning an interest on the cryptocurrency. In order to do this investors, need to deposit their tokens on an exchanges and then manually or through a bot allow margin traders to borrow their coins so they can hedge their bet. The benefit is the interest the price is the risk. CryptoLend is a bot which automated margin lending. In this interview Gilles explains the benefits of his bot.

What does CryptoLend.net do?

On the market of crypto currencies, traders have the possibility to trade on “margin”. It means that they can borrow additional money to bet on price movements and get larger gains than with their own funds. Once the trade is finished, the trader gives back its loan plus the interest.

In traditional banking, the Margin Trading is done with investors money. But here the Bitcoin world created something new. Some exchange platforms imagined a peer to peer system where anybody can lend their money into a Margin Lending market. Traders will borrow the available money to trade on margin, and lenders will earn the interest.

That means YOU can now earn interest by putting your money to work without the trading risks and you can do this on Cryptolend.net

How was CryptoLend born?

After an inglorious trial as a trader, we discovered the Margin lending feature in fall 2014. What interested us was the relative low risk and high gains during the Bitcoin “winter” from 2014 to 2016. Apart from the counterparty risk, there was no risk of losing capital and we gathered 20%/year on both bitcoins and US dollars.

At that time we created our own bot together with a friend, and we made it cross platform. We plugged it to Bitfinex’s USD and Poloniex’s BTC high rates. Since then we have been improving its robustness and performance.

Finally in may 2016 we had the idea to create an online web site, a SaaS (Software as a Service). The website has come a long way, as we had to create a professional dashboard and backend engine.

What are the advantages of using CryptoLend over lending manually?

If you have tried this feature by yourself you may have noted that loans are given back quite often and that rates are always changing. That is why it’s quite time-consuming to renew offers and adjust rates frequently.

The ‘auto renew’ features are not very efficient. It’s also possible to run a lending bot, but it requires time and skills.

Our website is an online bot. You can use it to lend your crypto currencies without being bothered by IT stuff. And we display numerous dedicated data and charts to help you monitor your gains. That’s why we think our service is adding value for lenders.

We support all the available currencies on 3 exchanges, including the leaders Bitfinex and Poloniex. You can lend your Bitcoins, Ether and many alt coins. Or you can lend USD, and never touch this crypto thingy.

Our main strategy is to maximize the capital lent. On top of that, we try to avoid rates really too low. They can come from the auto-renew people, from volatile days, and also from large amounts returned by traders, which collapse the rate for a moment.

Finally, we have added other strategies and settings, that our users can adjust to ensure that their lending is unique, as in any lending bot.

What are the average interest rates?

Currently, the long-term compounded returns are above 15%/year for BTC and USD lending. This rate is made of short bubbles with very high rates, and long periods or medium rates.

How many people are on CryptoLend the team?

My name is Gilles, I am French. I’m the only one actively working on the project, although we were two at the start. We had the original idea, and I did all the programming. My friend is a kind of guardian for the project.

Where can a new user start using CryptLend?

It’s pretty straightforward. Simply create a new account, make a deposit on your favourite exchange, then create an API key and copy it on our web site. Your funds should appear after a few minutes.

Then you can activate your lending bot and monitor your gains in the Intraday and Daily charts.

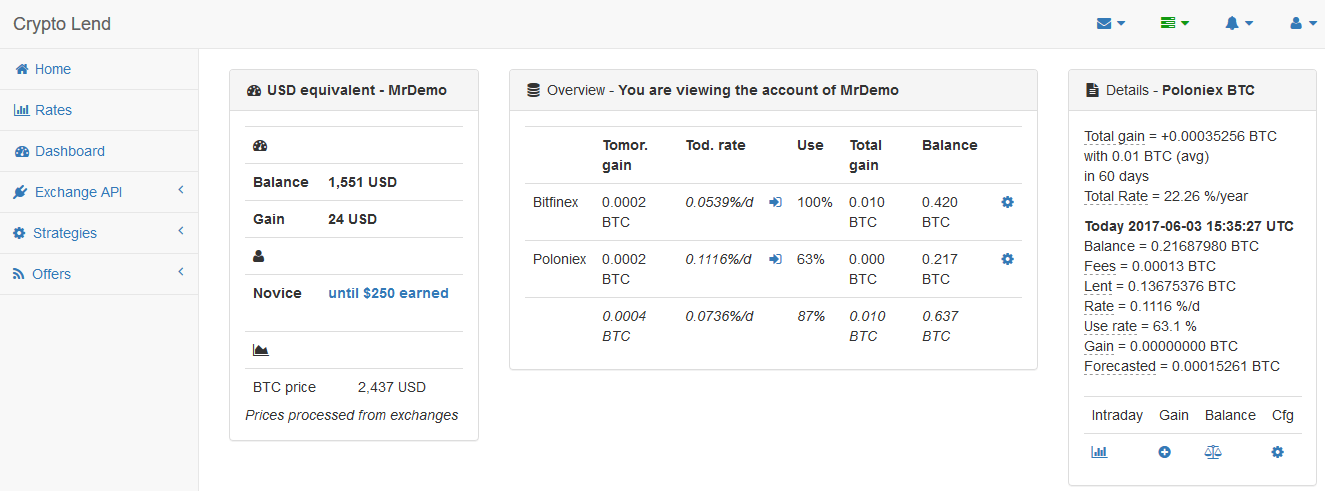

For instance, the picture below shows the dashboard of our demo account:

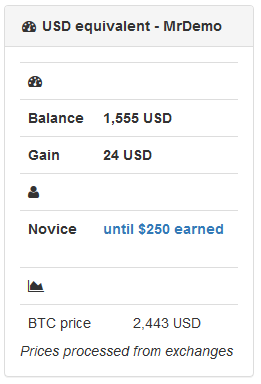

Panel “USD equivalent” recap your balance and total gains in USD equivalent:

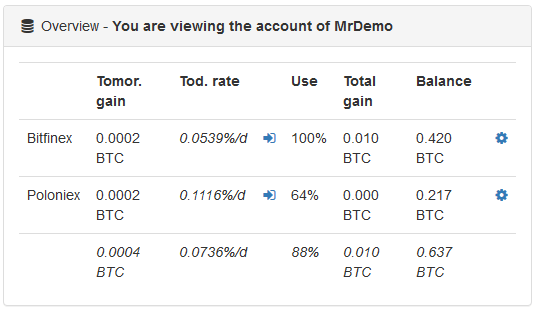

Panel Overview displays main data on each exchange and currencies:

When you click on the Details icon, it will update the panel below.

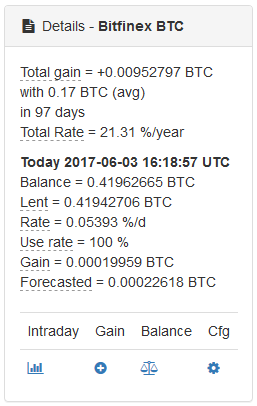

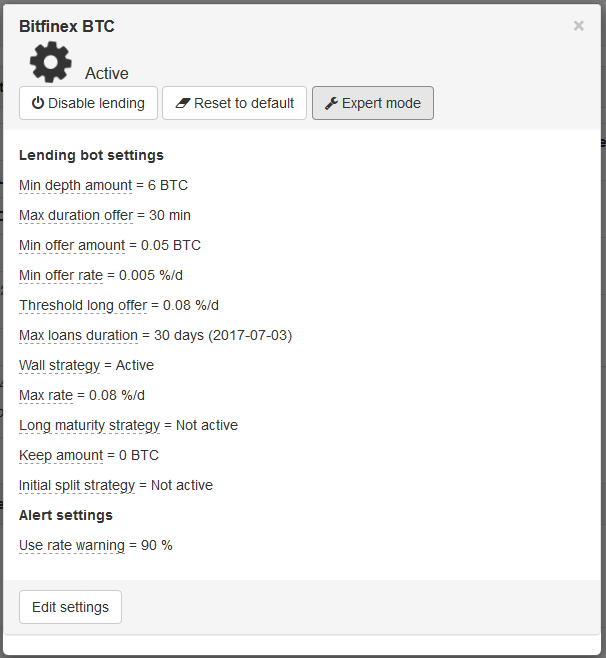

Panel Details displays dedicated lending data on this exchange/currency pair:

When clicking on the icons of the Details pane, you will see charts with Intraday, Daily gains and Daily Balance.

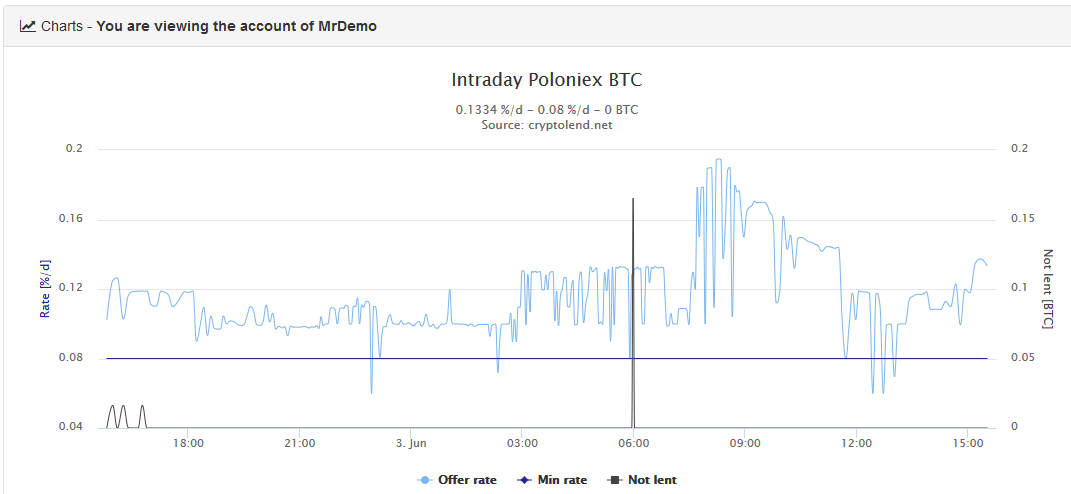

The intraday chart is quite useful to see the work of our bot and to test different strategies:

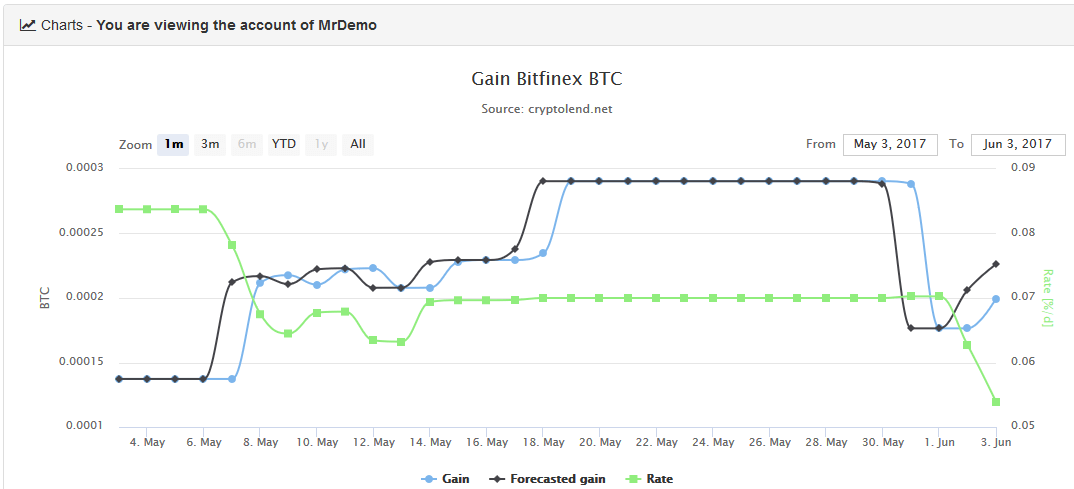

Daily Gains chart shows your long-term earnings:

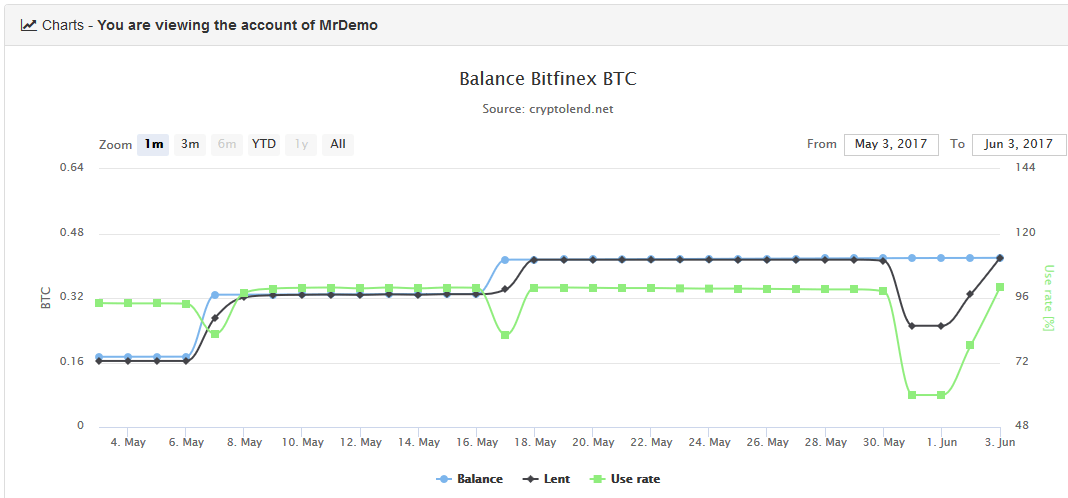

Daily Balance chart recaps your funds during lending:

What strategies can an investors use when lending on these platforms?

Once an investor has activated the bot, ythe settings can be adapted and activated specific strategies to try and increase your earning. These settings have default values, that will let you benefit from correct rates.

In some situations, changing the default settings may bring you a better return. For instance, you can change the duration of the Maximum loan, so that your loans are renewed more often. Or you can activate the “Initial Split Strategy”, to spread your initial funds over a period of time and thus average your rates on several small loans over a period of time. Each settings is described and documented in the site, and you can always join our Slack channel to ask your own questions.

What are the main differences in lending on the three platforms?

Poloniex and Bitfinex are both great platforms in terms of quality and volume. Quoine is not at the same level for the time being.

On Poloniex, the interest earned is kept until loans are returned by the borrower. Whereas on Bitfinex, the exchange calculates your earnings daily and deposit them on your account once per day.

The last months, Poloniex has seen higher rates for Bitcoin, probably because of the alt currencies bubble and also because of the Bitcoin scalability issue. And Bitfinex supports USD and sees quite high rates because of their current banking partnership problem. Lending rates are always linked to the trend and sentiment of the cryptocurrencies industry.

What is the difference between your platform and other competing systems?

What should investors look out for when selecting a lending robot?

You should start by lending manually with the exchange interface, even if it will be a disaster regarding rates. Then if you decide that you could invest more, we advise you to not use the exchange’s auto-renew service, because of its lack of efficiency.

Then you have the choice of configuring and running a bot at home or on a VPS. It allows to be completely independent and maybe lets you create your own strategies. But on the other hand it requires IT skills, you must take the cost into account, and you will devote a lot of your time because it must never crash.

That’s why we think our service may be interesting for people willing to focus on earning interest and not on computer technics.

We are proud to be the only Online lending robot with a cross-platform support, as all our competitors support only a single exchange. We also think that we are the fastest bot, as it processes every account each 1 to 2 minutes. Finally, we offer a very competitive price when compared to identical services.

What are the risks of using CryptoLend?

We could not runaway with your money, even if we wanted to!

Your money stays “safe” in your exchange account. You only give us the rights to create margin lending offers on your behalf, through the exchange’s API. No other rights are enabled, like trading or withdrawal.

In addition, we don’t ask any personal information during sign up. Security and Privacy are the basis of our reputation.

Are there any other risks ?

Crypto world IS very risky. The main one being the counterparty risk, which means a default of the exchange. You have to know that both Bitfinex and Poloniex has suffered serious hack and loss of funds. Contrary to the famous MtGox, both exchange are still alive but the toll was high for some people.

We address this by being cross-platform, to help mitigate the risk by splitting your funds over different exchanges.

What are the risks related to the lending on an exchange?

With Margin lending, your loans never go out of an exchange. When you lend your money, it actually stays in the exchange account. It is simply moved to the borrower in the internal ledger of the exchange. So there is no risk that a borrower leave with your money.

If Poloniex would lose a large amount of money, it may become insolvent. In that case, it should place itself in the hand of authorities, which would have to liquidate the company and spread its remaining funds among debtor, and former users. This is what’s currently happening with MtGox.

However, both Poloniex and Bitfinex succeeded to bypass the law, and refunded their clients after a few months time, with the ascent of the community.

The days after the hack, Bitfinex closed out all margin positions, so that funds return back to their original owners and interest should not count anymore.

Do you suspect margin lenders stack many small loans to to artificially lower the interest rates?

I don’t see how you could lower the interest rates by stacking many small loans, but it’s obvious that there are many attempts to manipulate the rates from both sides of the book. Some of them have been caught by the exchanges. We would rather stay away from the shenanigans and protect our reputation. Our goal is to profit as much as possible from the rates, whatever they are.

How many users do you have ? What is your business model ?

When turning our bot online, our first idea was that users feedback and ensuring improvements would benefit us as well as anybody. We always wanted to bring lenders more together.

One year later, we are now entrusted we the equivalent of USD 25m, which for example is 5-6% of Bitfinex total lendings. Many new users have joined us recently.

We are mainly doing this project for fun and experience. We still don’t have a specific business model, even if we invite users to become Premium members to help us cover the server costs. Maybe we will find a way to monetize our service in the future. Time will tell.

What is your price structure? Do you plan to change it in the near future?

New members have completely free access until they have earned at least $250 equivalent, plus 30 days. Then users have the choice to become Premium member for 17$/year, or to downgrade to a Basic free account, with limited bot speed and strategies available.

We don’t plan to change this price structure in the near future.

Do you plan to add new features?

Old members can attest, we are constantly adding improvements and new features, step by step.

Our main roadmap for next months includes:

- Keep on taking into account members feedbacks

- Improve UX/UI (embed settings change in dashboard, desktop notifications for low use rate, ‘asset manager’ feature) Add new strategies (spread the funds over time and into the lending book depth)

- Get back to our Derivatives system (Bitmex) which is too limited for the moment

- Plus a few other good ideas

If you had $1,000,000 and you had to invest them today in the Cryptomarkets, but you could only move them again in 10 years time. What would you do?

Interesting questions! It seems likely that Bitcoin and probably Ethereum are here to stay. In our opinion Bitcoin is the “king of crypto”, as it is the more stable store of value among crypto currencies. Ethereum brings something new as the “distributed world computer”. Everyone of us have an opinion on how we should invest a large amount of money, but please allow me to keep it for myself. Margin Lending is interesting precisely because it’s not a bet on the future, but a real industry, currently running and making money.

For more information visit : https://cryptolend.net/

We thank Gilles for the interview.