Interview with Giovanni Lesna head of Product development at Hedge Crypto.

What are the recent key highlights for Hedge Project?

In the previous month, there were several highlights and achievements of Hedge Token

Project in my personal opinion the most outstanding are:

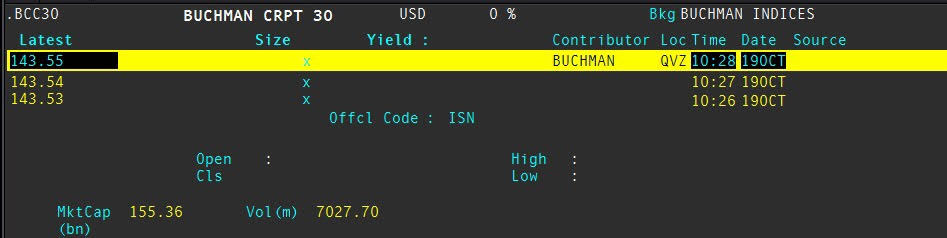

- Introducing the first professional crypto index to Thomson Reuters (tracker: BCC30), which tracks 30 biggest crypto assets/currencies and presents more than 90% of market capitalization. This is a relevant indicator of total crypto market fluctuations for a starting or professional investor,

- Confirming our plan for the whole family of professional indices and index-based products that are about to follow.

- Last but not least, Hedge Token finalised its Token Sale a week ago on 15th of October and is available for trading at hitBTC exchange.

What is the total amount contributed in the Hedge ICO?

Total amount raised in Hedge Token sale was 6283.07 ETH. Our token sale was under the radar and initialy offered only to our followers and supporters. We didn’t invest into marketing to raise as much as we can, but as much as we need for the successful development of the project.

Was this amount along with your expectations? How much of the roadmap can be created with the amount collected?

We introduced our project as one that will for sure bring added value to our investors and manage to raise before mentioned amount. For our future development reaching the minimum cap was crucial, raising more means quicker development. We are working hard on exceeding the expectations of our investors and reaching promised milestones and even more in the following months.

What have been the key takeaways from the Hedge Project roadshow?

Two roadshows in Barcelona and Dublin where we presented our first product BCC30 were a live introduction point of our team and possibility to meet industry leaders that supported our project and shared their opinion on our project with us and further on within their own network.

How is the Hedge Project organisation structured?

Our structure is relatively flat, we managed to gather industry experts on several topics and develop a well-organised team that seeks to develop its milestone in due time.

Hedge Project will facilitate the creation of index-based crypto products. What kind of products will Hedge Project create?

We will provide Crypto Traded Indices – crypto ETF equivalents. Meaning that the user will be

Head of Product Development Hedge Crypto

able to purchase any basket of cryptocurrencies by only one click (e.g. Crypto30, Crypto100, CryptoAsia Index, CryptoAssets etc.) These are passive investment vehicles with automatic rebalancing and recomposition according to the guidelines laid out in respective index rulebooks. “What you see is what you get” is the philosophy we stand by. Users can be confident in the parameters of their portfolio.

Can external managers use the Hedge Project platform to create their own fund?

Our instruments are passive investment vehicles. There is nothing to manage. Rebalancing and recomposition is automatic. This is also a reason why passive investment vehicles like Crypto Traded Indices by Hedge will be always cheaper than actively managed funds. Empirically we learn from financial world that index-based funds on average always outperformed actively managed funds.

I noticed that you-you describe your indexes ad “Commerical Crypto index”, what does the commercial refer to?

Commercial refers to commercialization and tradability we will provide. Existing indices on the market are at most hobby projects as they do not have a rulebook and index committee behind it. Every professional financial index (e.g. S&P500) has this, but in crypto, only our Buchman Crypto Indices have this. This way, our indices meet the ultimate prerequisites that financial institutions need to use write and trade index tied products.

We emphasize professional rebalancing and recomposition process, transparent and comprehensive rulebook and overall objectivity with index construction.

Is a crypto index copyrighted?

Yes. BC30 is copyrighted, as will be all our published indices that follow. Further 10 until the end of the year, among them, also Crypto Volatility Indices.

The first index the BCC30 will this be a fund, when will this fund be live?

We plan to launch our Crypto Traded Indices in Q1. Pilot run will be done on simpler indices, such as uncapped BC5 or BC10, after which we will deploy others. We are working closely with RIALTO.AI to calibrate their market-making bots which will keep the price of the CTIs as close as possible to the value of the underlying portfolio.

What is the rational with not including Bitconnect in the BC30?

Bitconnect lacks exchanges with a reliable data feed, which makes real-time index calculation impossible. The constituents in the index are determined based on the market capitalization and liquidity of the constituents. Rebalancing takes place monthly, therefore every cryptocurrency that meets the criteriums is included.

Why was the market cap chosen as the way to represent the weighting in the index?

What is crypto space known as market cap is in traditional finance free float-adjusted market capitalization. This is theoretically most correct way of indexing, employed for example by S&P 500 and DAX

What happens to coins which are stakable, generate gas or have forks, is this income reinvested?

Those are market in rulebook vocabulary as “corporate events” and the calculation methodology is determined based on the best financial industry practices. Our indices are dynamically adjusted. The only inputs required are circulating supply and price, and sufficient liquidity. If a forked coin has all of these above thresholds, it will be included in the index at next rebalancing.

What can investors in Hedge Project and investors wanting to invest in Hedge Project funds expect in the coming months?

We are finalizing the HDG distribution. In the next weeks we will work intensively to list the token on additional exchanges (as of now, HDG is already listed on Etherdelta and HitBTC). Next, we will finish the initial batch of the indices and start platform development. Indices will be published to all major financial data vendors (Thomson Reuters, Morningstar, Quandl etc.).

Trading platform onboarding and beta testing starts in Q1 2018, with full functionality in Q2. With progressive financial partnered institutions, we also wish to develop indexed based financial products, for example index tracker certificates.

There have been a lot of recent activity in the crypto fund space. Is this activity sustainable in the long-term and what are the key variables that will determine the shape of crypto funds in the future?

For sure one of the main determinations of crypto fund space will be the legislation, crypto economy is still quite unregulated compared to the traditional one, all organizations within the crypto economy not just crypto funds will have to adapt to future changes.

Second determination will be the investors’ interest in crypto economy, at the moment we are experiencing a quick growth in demand for crypto funds and in due time investors will develop into passive and active investors, where Hedge Project will offer attractive products for both of them.

For more information please visit: https://www.hedge-crypto.com/

We thank Giovanni Lesna for the interview, and Gasper Stih for the coordination.