Are you interested in exploring the world of watch investments? Look no further! “The Ultimate Guide: How to Invest in Watches” is here to provide you with all the essential information you need. Dive into this comprehensive guide, where you will discover valuable insights and tips on how to navigate the exciting watch market.

From understanding the different types of watches and their value drivers to learning about key factors to consider before making an investment, this guide covers it all. Whether you are a seasoned collector or new to the world of watches, you will find tips here that will help you make informed investment decisions. So, get ready to embark on a fascinating journey into the world of watch investing and unlock the potential of this unique market. Happy reading!

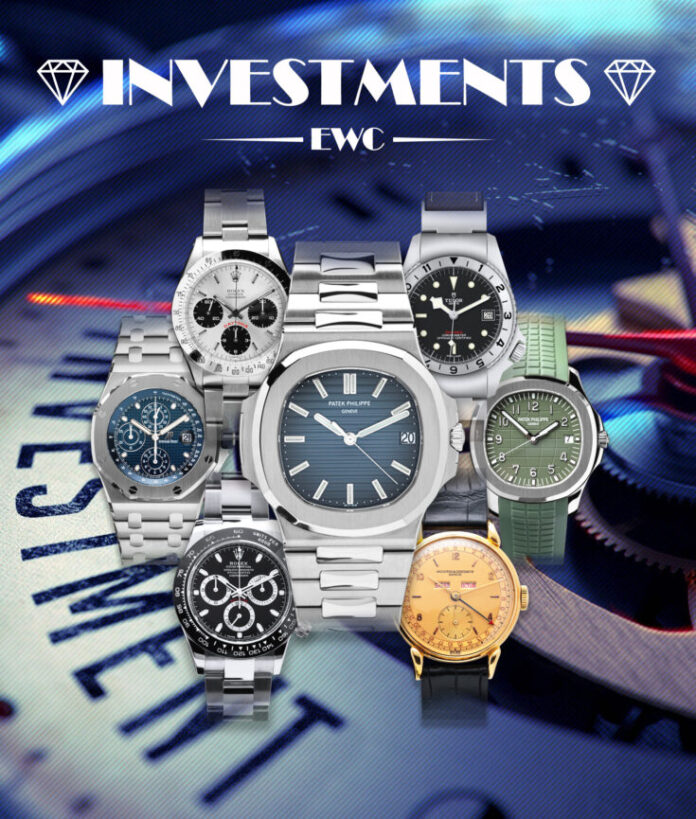

This image is property of www.europeanwatch.com.

## Understanding the Basics of Watch Investment

Investing in watches can be an exciting and profitable venture. However, like any investment, it requires careful consideration and research. To effectively invest in watches, it is important to understand the basics of the watch market, how to identify investment-grade watches, and the factors to consider in watch investment.

### The Watch Market: An Overview

The watch market is a dynamic and ever-evolving industry. From luxury timepieces to vintage collectibles, there is a wide range of watches available for investment. The market is influenced by factors such as brand reputation, historical significance, rarity, and overall demand. It is essential to have a good understanding of the market trends and dynamics before diving into watch investment.

### Identifying Investment-Grade Watches

Investment-grade watches are those that have the potential to increase in value over time. These watches are usually from renowned brands with a strong reputation and a history of producing exceptional timepieces. Factors such as craftsmanship, materials used, limited production runs, and iconic designs contribute to the investment potential of a watch. It is vital to conduct thorough research and consult experts to identify watches that have the potential to appreciate in value.

### Factors to Consider in Watch Investment

When investing in watches, there are several factors to consider. Firstly, it is important to identify your investment goals, whether you are looking for short-term gains or long-term appreciation. Moreover, diversification is key in building a watch investment portfolio. Investing in watches from different brands and eras can mitigate risks and maximize potential returns. Additionally, the potential of vintage watches should not be overlooked, as they often hold nostalgic value and have a strong collector following.

## Researching Watch Brands and Models

Before making any investment, it is crucial to thoroughly research watch brands and models to make informed decisions. This research phase helps in identifying the top watch brands for investment and popular models with investment potential. Additionally, understanding the rarity of certain watches and being aware of limited edition releases can contribute to the investment value of a timepiece.

### Top Watch Brands for Investment

Several watch brands are highly regarded among collectors and investors. Brands such as Rolex, Patek Philippe, Audemars Piguet, and Omega have consistently held their value and have a strong market demand. These brands are known for their craftsmanship, innovation, and heritage, making them attractive to potential buyers in the future.

### Popular Models with Investment Potential

Within each brand, certain models have proven to be particularly popular among investors. For example, the Rolex Submariner, Patek Philippe Nautilus, Audemars Piguet Royal Oak, and Omega Speedmaster are widely recognized as iconic models with a strong investment potential. These watches have become symbols of elegance and luxury, and their appreciation in value is driven by their desirability and scarcity.

### Rarity and Limited Edition Watches

Rarity plays a significant role in the investment potential of a watch. Limited edition watches, often produced in small quantities, tend to appreciate in value due to their exclusivity. Collectors and enthusiasts are willing to pay a premium for watches that are hard to find. Understanding the concept of rarity and limited edition releases is crucial in identifying watches with a high potential for investment returns.

This image is property of www.luxurylifestylemag.co.uk.

## Evaluating Watch Condition and Authenticity

When investing in watches, it is essential to ensure their authenticity and evaluate their condition. These factors significantly impact the value of a timepiece and its potential for investment.

### Signs of Authenticity

To determine the authenticity of a watch, there are certain key indicators to look for. These include the quality of craftsmanship, the accuracy of the movement, the presence of original parts, and the proper branding and markings. Working with reputable sellers and seeking professional opinions can help verify the authenticity of a watch before making an investment.

### Condition and Maintenance History

The condition of a watch is also critical in determining its investment value. Watches that have been well-maintained and serviced regularly are more likely to retain their value and appeal to potential buyers. Evaluating the maintenance history, including service records and any repairs, can provide insight into the overall condition of a watch.

### Verification and Certification

To ensure the legitimacy and investment potential of a watch, verification and certification are essential. These can be obtained from reputable watch experts and certification organizations. Certifications provide assurance of authenticity, condition, and provenance, which are vital when buying and selling watches as investments.

## Determining the Investment Strategy

Having a clear investment strategy is crucial when investing in watches. This strategy should outline your goals, time horizon, and risk tolerance.

### Short-Term vs. Long-Term Investments

Short-term investments in watches involve buying and selling within a relatively short period, often taking advantage of market fluctuations. Long-term investments, on the other hand, involve holding watches for an extended period to maximize potential appreciation. It is important to consider your investment goals and time horizon when determining whether to pursue short-term gains or long-term growth.

### Diversification and Portfolio Building

Diversification is a key principle in investing, and it applies to watch investment as well. Building a diverse portfolio with watches from different brands, models, and eras can spread the risks and potentially increase the likelihood of overall returns. By investing in a range of watches, you reduce the impact a single watch’s performance can have on your investment.

### The Potential of Vintage Watches

Vintage watches hold a unique place in the watch market and can offer significant investment potential. These watches often have historical significance, limited availability, and a strong collector following. They can appreciate in value significantly over time, making them valuable additions to an investment portfolio.

This image is property of globalboutique.com.

## Identifying Reliable Sellers and Marketplaces

Finding trustworthy sellers and marketplaces is crucial when buying or selling watches as investments. The reputation and credibility of the seller can greatly impact the authenticity, condition, and overall value of a watch.

### Authorized Dealers and Boutiques

Authorized dealers and boutiques that carry reputable watch brands are often reliable sources for authentic watches. These sellers have direct relationships with the brands, ensuring the watches they offer are genuine and come with proper documentation. However, prices at authorized dealers may be higher than other sources.

### Auction Houses and Online Platforms

Auction houses provide a platform for buying and selling high-end watches. These auctions offer access to rare and collectible timepieces, but the bidding can be competitive and prices may be driven up. Online platforms, such as reputable watch marketplaces and forums, provide a wider selection of watches, but caution must be exercised to ensure authenticity and trustworthiness of the sellers.

### Reputation and Customer Reviews

Before engaging with any seller, it is prudent to research their reputation and read customer reviews. This can provide insights into their credibility and the overall satisfaction of previous buyers. Established sellers with positive reviews and a strong reputation are more likely to provide a trustworthy buying experience.

## Understanding Price Trends and Market Demand

To make informed investment decisions, it is important to understand the factors that influence watch prices and gauge market demand.

### Factors Influencing Watch Prices

Several key factors impact watch prices, including brand reputation, model popularity, scarcity, condition, and market trends. Influences such as limited edition releases, celebrity endorsements, and historical significance can drive up prices. Understanding these factors can help predict future price trends.

### Market Demand for Different Brands

Market demand for watches varies among different brands and models. Certain brands have established themselves as highly sought-after due to their reputation and desirability. Understanding the current market demand for specific brands and models can help identify watches with the potential for future appreciation in value.

### Researching Historical Price Data

Analyzing historical price data is essential in identifying patterns and trends in watch values. This data can provide insights into how watches from certain brands and models have appreciated over time. By examining price data, you can gain a better understanding of the potential investment returns for specific watches.

This image is property of i.ytimg.com.

## Investing in Pre-Owned and Vintage Watches

Investing in pre-owned and vintage watches can offer unique opportunities to acquire rare and collectible timepieces.

### Assessing Pre-Owned Watch Values

When investing in pre-owned watches, it is crucial to assess their value accurately. Factors such as brand reputation, model popularity, condition, and authenticity play significant roles in determining the value of pre-owned watches. Working with expert appraisers and sellers can help ascertain the fair market value of pre-owned timepieces.

### Vintage Watches as Collectibles

Vintage watches hold a special place in the hearts of collectors and enthusiasts. These watches are often highly sought after due to their unique designs, historical significance, and limited availability. Investing in vintage watches requires careful research and expertise to identify authentic pieces with potential for appreciation.

### Consulting Experts and Appraisers

To navigate the complexities of investing in pre-owned and vintage watches, it is advisable to consult with experts and appraisers. Their knowledge and experience can help authenticate watches, assess their condition, and provide guidance on their investment potential. Relying on expert opinions ensures that you make informed investment choices.

## Managing Your Watch Collection and Investments

Once you have built a watch collection, it is important to effectively manage your investments to preserve their value and maximize potential returns.

### Secure Storage and Insurance

Proper storage conditions are essential to protect the value and integrity of your watch collection. Watches should be stored in a secure, climate-controlled environment to prevent damage from heat, moisture, and dust. Additionally, obtaining appropriate insurance coverage ensures that your watches are protected against loss, theft, or damage.

### Regular Maintenance and Servicing

Regular maintenance and servicing are crucial to preserving the condition and value of watches. Following manufacturers’ recommended service intervals and entrusting reputable watchmakers for repairs and maintenance are important steps in ensuring the longevity and performance of your timepieces.

### Tracking and Monitoring Market Trends

The watch market is constantly evolving, and staying informed about market trends is key to effectively managing your investments. Continuously monitoring prices, demand, and industry developments can help you make timely decisions, such as when to buy, sell, or hold certain watches.

This image is property of millenarywatches.com.

## The Role of Authentication and Documentation

Authentication and proper documentation are crucial elements in the watch investment process. They provide legitimacy, provenance, and confidence in the value of a watch.

### Importance of Authenticating Watches

The authenticity of a watch is paramount to its investment value. Ensuring that a watch is genuine and not a counterfeit is crucial in building a reputable watch collection. Authenticating watches involves examining key indicators of authenticity, such as the movement, case, dial, and parts, alongside verifying the watch’s history and documentation.

### Proper Documentation for Investments

Proper documentation, including receipts, certificates, and service records, is vital in establishing a watch’s provenance and value. Documentation provides evidence of authenticity, history, and condition, which are essential when buying, selling, or insuring watches as investments. Keeping all documentation organized and accessible ensures peace of mind and facilitates future transactions.

### Professional Authentication Services

For added assurance and peace of mind, professional authentication services can be utilized. These services specialize in examining and verifying the authenticity of watches, offering expert opinions and certifications. Engaging trusted authentication services can provide independent validation of a watch’s authenticity, which is especially valuable for high-value and rare timepieces.

## Evaluating Future Investment Potential

An essential aspect of watch investment is evaluating the future potential of your investments. This entails considering emerging trends, analyzing the industry outlook, and assessing growth opportunities and risks.

### Emerging Trends in Watch Investment

As with any investment market, the watch industry experiences emerging trends that can shape future investment opportunities. Paying attention to factors such as technological advancements, changing consumer preferences, and shifts in fashion trends can help identify watches with the potential to appreciate in value.

### Analyzing Industry Outlook

Understanding the overall industry outlook is crucial in making informed investment decisions. Researching market forecasts, staying informed about industry news and developments, and analyzing economic factors can provide insights into the future prospects of the watch market.

### Growth Opportunities and Risks

While watch investments can be lucrative, they are not without risks. It is important to assess both the growth opportunities and the risks associated with investing in watches. Factors such as market volatility, changing consumer preferences, economic downturns, and shifts in brand perception can impact the investment potential of watches. Conducting thorough research and regularly reviewing your investment strategy can help mitigate risks and capture opportunities for growth.

In conclusion, investing in watches can be a rewarding journey. By understanding the basics of watch investment, researching brands and models, evaluating condition and authenticity, determining your investment strategy, identifying reliable sellers, understanding price trends and market demand, investing in pre-owned and vintage watches, managing your collection, considering authentication and documentation, and evaluating future investment potential, you can make informed decisions and increase your chances of success in the world of watch investment. Remember, it is important to conduct thorough research, seek expert advice, and stay informed to make wise investment choices.